Dennis Rodkin

Crain’s Chicago Business

November 06, 2023

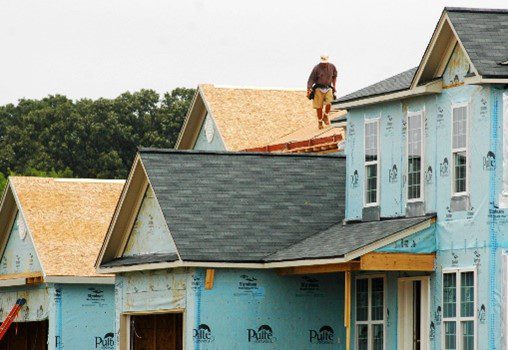

Credit: Twin Vines Real Estate Services This new house on Lucent Lane in Naperville sold in October for just under $681,000.

Four times in recent months, real estate agent Nikit Tailor’s clients have switched from looking for an existing home to buy to shopping the new-construction offerings, and all have bought one.

“Before about a year ago, I barely did any new-construction sales,” said Tailor, a Coldwell Banker agent based in Libertyville. “Now they’re all asking.” In mid-October, Tailor’s Naperville clients who converted to new-house hunting paid just under $681,000 for a house on Lucent Lane. Three other buyers he represented have deals at various stages for homes in Plainfield, Yorkville and Bartlett.

This week dawned with a call from another client who is tired of the frustrating search among the low inventory of homes offered for resale in St. Charles and asked to see some new-build listings. “I told him it makes sense to do that,” Tailor said. “We’ll find him something.”

The switches are coming mostly because the inventory of resale homes is extremely tight. People with low-cost mortgages from the times before interest rates doubled in 2022 are reluctant to sell because they’d have to buy at present interest rates, which are over 7%.

The shortage of existing homes helped push sales of new-construction homes up during the third quarter of the year, said Erik Doersching, president and CEO of Tracy Cross Associates, a homebuilding consultancy based in Schaumburg. Homebuilders in the Chicago area sold 1,302 new units in the third quarter of this year, an increase of nearly 41% from the same period in 2022, according to the firm’s latest report, which was released late last week.

That’s even stronger than the previous quarter, when sales were up almost 38%. They’ve more than made up for a steep drop in the first quarter, and now, year-to-date, home sales are up 8.4%.

New home developments are “absolutely”pulling in customers from the tight existing-home market, Doersching said, but it’s not only the mere availability of a house that’s pulling them in. Unlike individuals selling their family home, the big national homebuilding firms that make up 80% of the Chicago area’s new home sales all have the financial wherewithal to offer reduced interest rates as “their primary incentive in this high interest rate climate,” Doersching said.

For some of Tailor’s clients, the builder’s offer of lower interest rates or other incentives, like a $20,000 package of upgrades, reduced the cost difference between existing homes and new product. While the available new homes are priced higher than existing homes, Tailor said, “those incentives knock it back down to the price they were looking at” in the existing home market.

Credit: Bloomberg

The major national homebuilders all make a regular practice of declining to comment to Crain’s on their sales and the Tracy Cross reports.

If new homes are a solution to the tight inventory housing market, why aren’t more of them being rushed onto the market? “It’s not like baking more loaves of bread to get on the shelves,” Doersching said. Getting new homes onto the market “is a process that can take two years, with land acquisition, permitting and construction.”

There’s also the problem that much of the land that’s available for building is in the outer rings of the metro area, while demand for homes is strongest in the inner- or mid-range rings.

“Our supply of land is disjointed,” Doershing said.

Elmhurst is feeling it. In this older, established suburb that has been an epicenter of teardowns for more than 20 years, “we’re desperate to find land to build on now,” said Tim Schiller, an @properties Christie’s International Real Estate agent who handles many of the new-build sales in town. Demand, he said, is high, particularly from Chicago residents planning a move to Elmhurst. “They want new,” he said. “They don’t want something dated.”

The lack of sites to build on has its upside, of course. “Having low inventory keeps prices high,” said Schiller. His team represented a new five-bedroom, roughly 3,470-square-foot house on Third Street that sold for about $1.07 million in mid-October.

“If we had a few more, we could sell them,” Schiller said.

A comparison to national data shows Chicago’s pool of new home offerings is far shallower than what it’s like nationwide. Redfin reported in late October that about 31% of homes for sale were new construction. That’s considerably higher than the proportion offered here. Crain’s research in the Midwest Real Estate Data listings indicates that about 7% of the homes for sale in the six-county metro area are new construction.

One significant reason for the difference is that the homebuilding industry in the Chicago area was laid low by the fallow 2010s. From an early-2000s peak of selling over 25,000 new homes a year, the industry dropped to less than one-fifth of that for a long stretch and only began solid recovery during the COVID-era housing boom.